Understanding PrimeXBT Margin Trading

Margin trading offers traders the ability to amplify their potential profits, and one platform that has made significant strides in this area is PrimeXBT Margin Trading PrimeXBT Margin Trading. In this article, we will explore the intricacies of margin trading, its benefits, and how PrimeXBT stands out in the competitive landscape of cryptocurrency exchanges.

What is Margin Trading?

Margin trading allows traders to borrow funds to increase their trading positions, offering the opportunity to leverage their investments to potentially gain larger returns. While this can magnify profits, it also increases risks significantly. By using margin, traders can initiate positions that are larger than their actual account balance, but they should proceed with caution.

How Does Margin Trading Work?

At its core, margin trading involves borrowing funds from a broker to trade assets. Here’s a simplified breakdown of how margin trading works on PrimeXBT:

- Initial Deposit: Traders must deposit a percentage of their total position size, known as the margin requirement.

- Leverage: This concept refers to the ratio of borrowed funds to the trader’s own funds. For instance, a 100:1 leverage allows you to control a position worth $10,000 with just $100 in your account.

- Margin Call: If the market moves against the trader’s position, they may receive a margin call that requires them to deposit more funds to maintain their position.

Benefits of PrimeXBT Margin Trading

There are several advantages to using PrimeXBT for margin trading:

- High Leverage: PrimeXBT offers competitive leverage options, allowing traders to maximize potential returns with minimal capital.

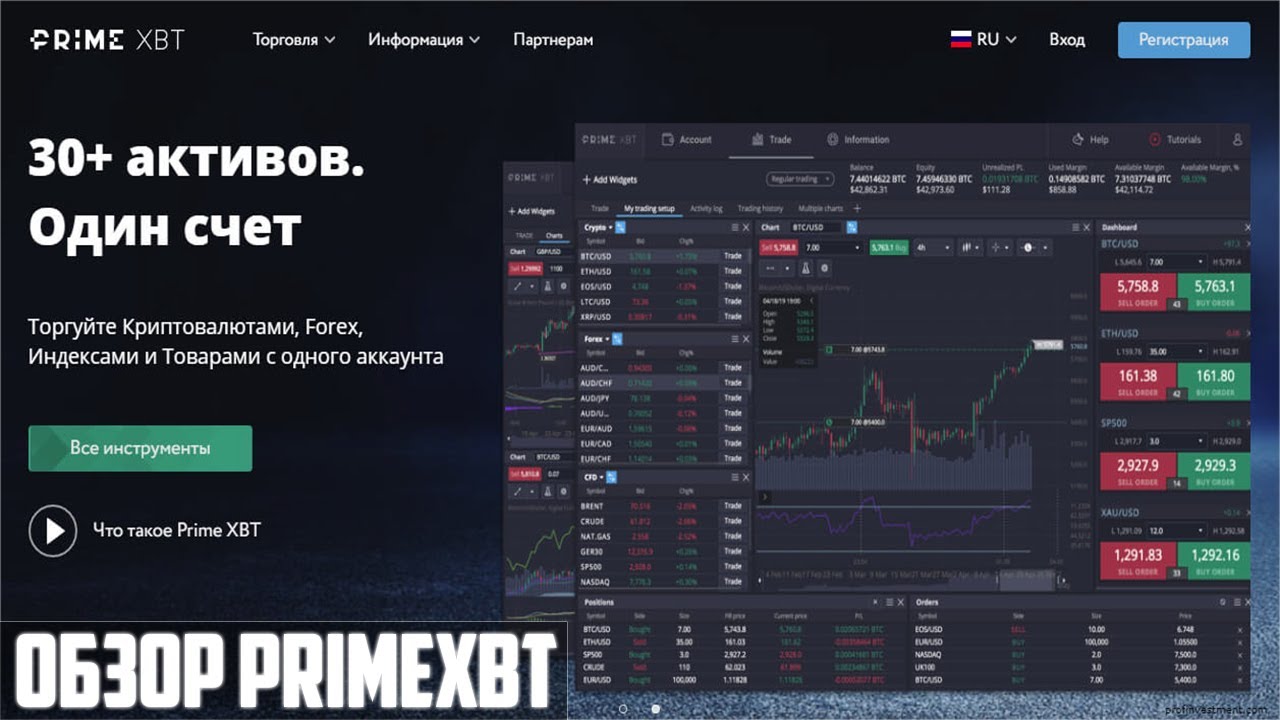

- Diverse Asset Selection: The platform supports a wide variety of cryptocurrencies, forex, and commodities for margin trading.

- User-Friendly Interface: Designed for both novices and experienced traders, PrimeXBT’s interface is intuitive, making it easy to navigate.

- Advanced Trading Tools: Features like analytical charts, indicators, and trading strategies enhance the trading experience and help make informed decisions.

Strategies for Margin Trading on PrimeXBT

Successful margin trading requires a solid strategy. Here are some effective strategies to consider:

1. Trend Following

This strategy involves identifying the current trend and making trades that align with it. By analyzing price movements and using technical indicators, traders can catch upward or downward trends early on.

2. Scalping

Scalping is a short-term trading strategy where traders aim to make small profits from multiple trades throughout the day. This method requires quick decisions and a keen understanding of market movements.

3. Swing Trading

This strategy involves holding positions for several days or weeks, allowing traders to capitalize on anticipated market swings. Swing traders often rely on news events and market sentiment.

Risks Associated with Margin Trading

While margin trading can lead to significant gains, it is not without its risks:

- High Volatility: Cryptocurrency markets are notorious for their volatility, which can lead to sudden losses.

- Liquidation Risk: If the market moves against a trader’s position significantly, there is a risk of liquidation, where the broker closes the position to prevent further losses.

- Emotional Stress: The pressures of trading on margin can lead to emotional decisions, which may harm trade outcomes.

Conclusion

PrimeXBT Margin Trading offers a robust platform for traders looking to take their trading to the next level. By understanding how margin trading works, its benefits, and the strategies to use, traders can optimize their potential for success while being mindful of the inherent risks. Whether you are a novice or an experienced trader, PrimeXBT provides the tools and opportunities needed to thrive in the fast-paced world of margin trading.